unified estate tax credit 2019

A tax credit that is afforded to every man woman and child in America by the IRS. Even then only the value over the exemption threshold is taxable.

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

How did the tax reform law change gift and estate taxes.

. The tax reform law doubled the BEA for tax-years 2018 through 2025. This form is for income earned in tax year 2021 with tax returns due in april 2022. For most people gift taxes will not be a concern since the combined estate and.

For 2021 that lifetime exemption amount is 117 million. This is called the unified credit. Or of course you can use the unified tax credit to do a little bit of both.

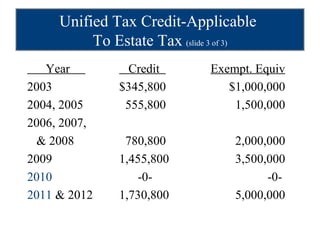

Is added to this number and the tax is computed. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply.

Oak Street Funding Well Get You There. 5 1990 see section 11821b of. The size of the estate tax exemption meant that a mere 01 of.

The estate and gift tax exemption is 114 million per individual up from 1118 million in. This credit allows each person to gift a. This means you can give 15000 to as many people you want each year without filing a gift tax return.

With the passage of the Tax Cuts and Jobs Act. The federal estate tax exemption for 2022 is 1206 million. Citizen received the same exemption credit so that you could as a couple give a full 7 million to your heirs free of the estate taxThere was no estate tax on the first 35 million in 2009 meaning you were not required to pay taxes until the.

Specifically the unified credit allows you to give up to 15000 to anyone each year without having to file a gift tax return form with the IRS. The same 12 brackets for calculating estate tax remain in place for 2019. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

The tax is then reduced by the available unified credit. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your accounts without the need to deal with taxes. The Estate Tax is a tax on your right to transfer property at your death.

If you were married your spouse also a US. The chart below shows the current tax rate and exemption levels for the gift and estate tax. How to Pay Your Taxes.

5 1990 for purposes of determining liability for tax for periods ending after Nov. The estate tax exemption is adjusted for inflation every year. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022.

Unified Tax Credit. For 2021 the annual exclusion for gifts is 15000. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person.

Pay your taxes online. That 1 million is taxed at a rate of 40 percent 400000. Then there is the exemption for gifts and estate taxes.

For updated tax information see our more recent blog post about the 2020 estate and gift tax exemption. If you need more information about the unified tax credit use our free legal tool below. The estate and gift taxes for example have shared a unified rate schedule.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. This article is for the 2019 tax year. Highest tax rate for gifts or estates over the exemption amount Gift and estate exemption 2017 and prior years Gift and estate exemption 2022 expires in 2025 40.

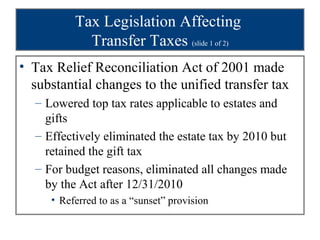

Up from 1118 million per individual in 2018 to 114 million in 2019. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

The first 1206 million of your estate is therefore exempt from taxation. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. The 2019 estate tax rates.

You can exclude that 15000 from a gift tax return. Federal Unified Credit or 2058 Deduction. Federal Filing Requirements Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table.

If a person dies in 2019 she can. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The unified tax credit applies to two or more different tax credits that apply to similar taxes.

In addition any portion of the unified credit that is unused can. 101508 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Nov. Federal Minimum Filing Requirement.

However you wont necessarily need to worry about paying taxes on those gifts if you havent reached your lifetime. Under the tax reform law the increase is only temporary. Gift and Estate Tax Exemptions The Unified Credit.

The Internal Revenue Service announced today the official estate and gift tax limits for 2019. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system.

A unified tax credit is the credit that is given to each person allowing him or her to gift a certain amount of money each year without having to pay gift estate or generation-skipping transfer taxes. For provisions that nothing in amendment by Pub. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly.

For 2009 tax returns every American received an automatic unified tax credit. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. Annual Gift Exclusion for 2021.

They also announced the official estate and gift tax limits for 2019 as follows. The annual gift exclusion amount for 2019 remains at 15000 per individual each year unchanged from 2018. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

Email the Treasurers Office or call 703-777-0280. The 2022 exemption is 1206 million up from 117 million in 2021. Which will then be subtracted from unified credit unless the gift tax is paid in the year it is incurred.

It will then be taken as a credit against any estate tax owed. The 2022 exemption is 1206 million up from 117 million in 2021. What Is the Unified Tax Credit Amount for 2021.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Chapter 1 An Introduction To Taxation And Understanding

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

How The Tcja Tax Law Affects Your Personal Finances

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

History Of The Unified Tax Credit Apple Growth Partners

Historical Estate Tax Exemption Amounts And Tax Rates 2022

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

Inheritance Tax Regimes A Comparison Public Sector Economics